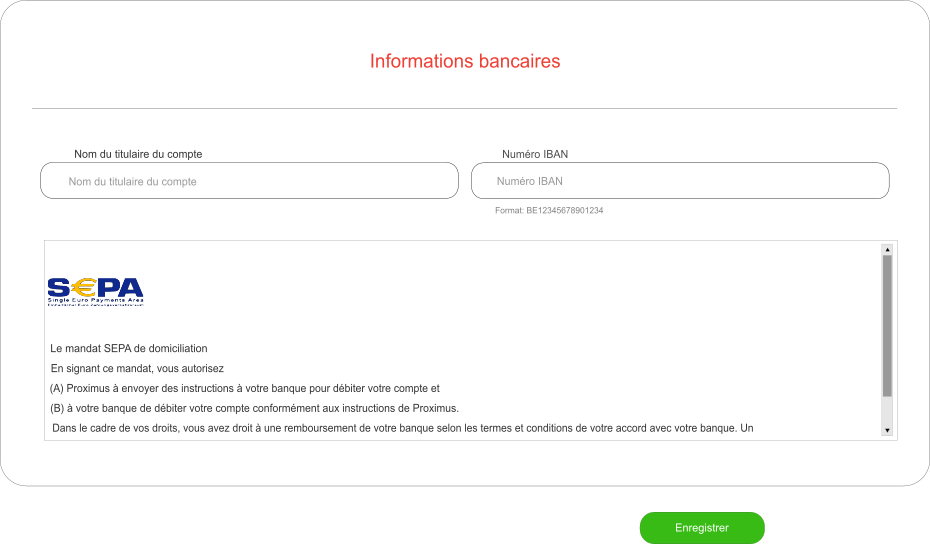

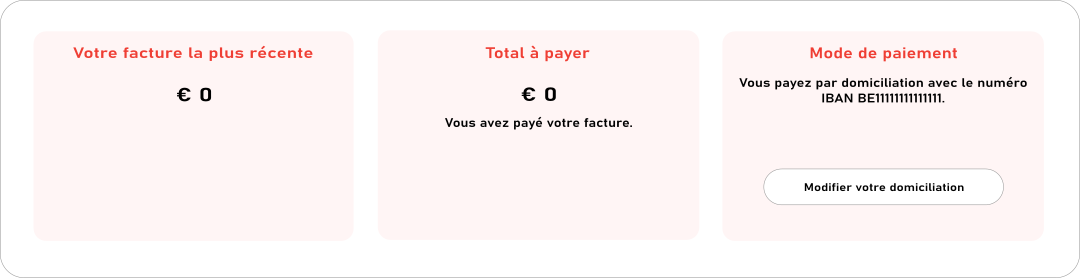

Information about your direct debit

Do you have enough information?

No, I need more help

Yes, thank you!